Statistical Tools in Finance and Insurance (VL)

Description

The course offers an overview of advanced statistical methods in quantitative finance and insurance which should be comprehensible for a graduate student in financial engineering as well as for an inexperienced newcomer who wants to get a grip on advanced statistical tools applied in these fields.

The registration in the respective Moodle course is obligatory.

Course outline

The course consists naturally of a finance and insurance part. Each part contains lectures with high focus on practical applications.

The course consists naturally of a finance and insurance part. Each part contains lectures with high focus on practical applications.

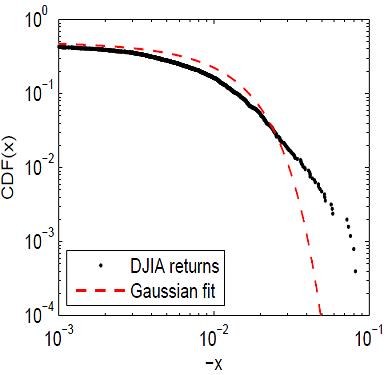

The finance part starts with an introduction to stable distributions, which are the standard model for heavy tailed phenomena, e.g. stock returns. Their numerical implementation is thoroughly discussed, applications to finance and possible extensions are given. Next lectures present a risk measure called expected shortfall for several assymetric, fat-tailed distributions. This topic is extended in the subsequent lectures which deal with the expected shortfall for sums of random variables. The course proceeds with modelling heteroscedasticity in nonstationary financial time series, an important technique to capture the stylized facts of stock prices.

The next part of the course employs Heston model to tackling the implied volatility smile in FX markets. The relative simplicity and the direct link of model parameters to the market makes Heston's model very attractive to front office users. Option pricing and parameter calibration is discussed in the course. We show how the computational complexity of stochastic volatility models can be overcome with the help of the Fast Fourier Transform. Some extensions of the Heston model are introduced as well. Afterwards the valuation of weather derivatives, financial contracts allowing to transfer weather risks, is discussed in the course. These derivatives are based on weather indices like average temperature, cumulative rainfall or snowfall in specified location and over some calendar period. Their underlying is thus nontradable, which demands alternative pricing methods, presented in this part of the course. The pricing is illustrated on the example of some Asian cities. We proceed by introducing another kind of exotic derivatives: variance swaps. These derivatives allow volatility trading and can be replicated by other traded derivatives. Valuation and hedging of variance swaps is discussed in this part. It is followed the topic of predicting corporate bankruptcy with Support Vector Machines.The technique introduced classifies companies into the companies which are at bankruptcy risk and those which are not based on their financial ratios.

Next lectures present network structure analysis based on distance matrix, which is illustrated on the example of financial market structure and its dynamics.

The insurance part of the course starts with a lecture on loss distributions. The basic models for claim severities are introduced and their statistical properties are thoroughly explained.

The insurance part of the course starts with a lecture on loss distributions. The basic models for claim severities are introduced and their statistical properties are thoroughly explained.

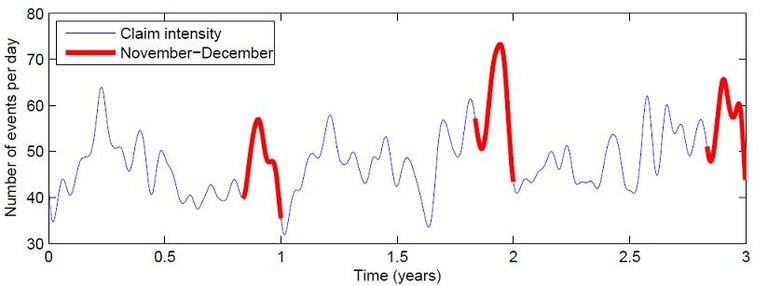

During lectures, the methods of simulating and visualizing the risk process are discussed. This topic is followed by an overview of the approaches to approximating the ruin probability of an insurer. Both exact and approximative ruin probability calculations are presented. Some of these methods are extended during next lectures, where classical and anomalous diffusion approximations to ruin probability are discussed and extended to cases when the risk process exhibits good and bad periods.

The next topics are related to one of the most important aspects of the insurance business - premium calculation. We introduce a diversity of models for property and casualty insurance pricing. We detail modelling claim frequency and claim severity and discuss the diagnosing these models.

The subsequent lectures review the market in catastrophe insurance risk, which emerged in order to facilitate the direct transfer of reinsurance risk associated with natural catastrophes from corporations, insurers, and reinsurers to capital market investors.

Finaly we review approaches to modelling equity-linked retirenment plans. Different strategies as stop loss strategy and cost structures are presented and evaluated.

Literature and Sources

- Cizek, Härdle, Weron (2011) "Statistical Tools for Finance and Insurance" 2nd ed., Springer Verlag.

- Franke, Härdle, Hafner (2011) "Statistics of Financial Markets", 3rd ed.,Springer Verlag.

- Härdle, Hautsch, Overbeck (2009) "Applied Quantitative Finance. 2nd extended ed.,Springer Verlag.

- Härdle, Simar (2012) "Applied Multivariate Statistical Analysis", 3rd ed., Springer Verlag.

- Gentle, Härdle, Mori (2012) "Handbook of Computational Statistics, Concepts and Methods", 2nd ed., Springer Verlag.

- Klugman, Panjer and Willmot (1998) "Loss Models: From Data to Decisions", Joh Wiley & Sons.

-

www.quantlet.de (source codes)

www.quantlet.de (source codes)